Insurance Contract Negotiation Services

Unlock the rates your practice truly deserves. At NGA Healthcare, our sole focus is to obtain higher reimbursement rates through our contract negotiations, ensuring that all of our clients secure a return on their investment from our negotiation efforts, or we return our fees!

Let us help you maximize your practice’s potential!

Experience the difference of our expert insurance contract negotiation services

Significant Revenue Boost

Benefit from substantial fee schedule increases, averaging 10-20%, directly impacting your bottom line.

Accelerated Insurance Contract Negotiations

Experience faster healthcare contract negotiations, outpacing what groups or competitors can achieve on their own.

Maximize Payer Revenue

Protect and enhance your revenue by combating the impact of declining reimbursements through strategic insurance contract negotiations.

Comprehensive Healthcare Contract Management

Enjoy seamless contract management, from initial negotiations to credentialing, application submission, and rate setting.

Tailored Procedure Negotiations

Ensure the most important codes and procedures for your practice are prioritized and secured during payer contract negotiations.

"After trying for nearly two years, NGA Healthcare was able to get my practice an increase in only three weeks! This will add over $150,000 to our bottom line."

- Pinnacle Internal Medicine

The Insurance Contract Negotiation Process

1

Initial Consultation

We kick off with a detailed consultation to assess the current state of your payer contracts and identify pain points specific to each practice.

2

Tailored Proposal

NGA submits a customized proposal outlining the process, fees, and strategies designed to maximize your revenue potential.

3

Comprehensive Data Collection

Once you engage our services, we provide a detailed list of required data points and information. This enables us to conduct a thorough analysis of your rates and craft a compelling value proposition.

4

In-Depth Reimbursement Analysis

We meticulously benchmark your practice's allowable rates by individual CPT codes against Medicare, providing a granular understanding of your financial baseline.

5

Strategic Value Proposition Development

We create a robust value proposition that showcases your practice’s unique strengths and cost-saving opportunities, tailored specifically for each health plan.

6

Persistent Negotiation Process

Our team submits the value proposition to each plan and rigorously negotiates on your behalf. We are relentless in our pursuit, making a compelling case for increased rates and refusing to accept “No” as an answer.

NGA Healthcare is dedicated to securing higher rates for your practice. Even in the face of prolonged stalling and delays, we persist in negotiations until we achieve the increase your practice deserves.

Why choose NGA Healthcare to negotiate your contracts?

Decades of Experience

NGA Healthcare has been in operation since 2013, and we have decades of Payer Negotiation Experience.

Guaranteed Pricing

We don’t get paid unless we receive an increase for you. NGA Healthcare is a performance based company. We charge a small upfront initiation fee and then receive a % of the negotiation increase that we get for the company.

Deep Payer Relationships

Our extensive network of relationships with thousands of plan contacts, combined with our deep understanding of the payer landscape, gives us a unique advantage in negotiating favorable terms for you.

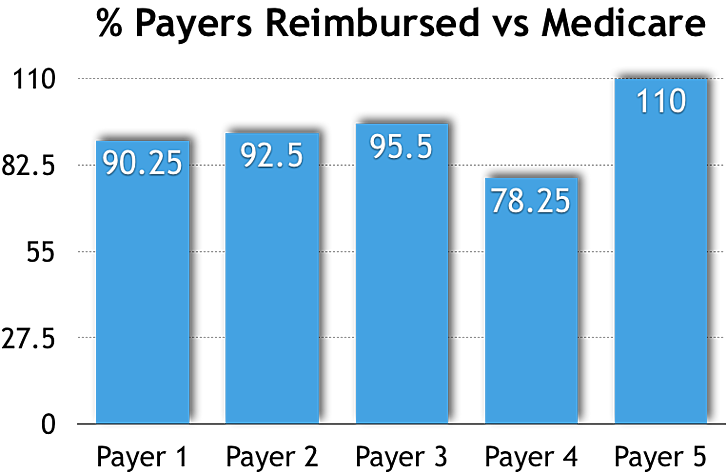

A Case Study of a Payer Contract Negotiation

This medium-sized practice has been open for 6 years and has a roster of 5 medical doctors and 3 mid-level providers. Annual Revenue is $4,650,000* broken down according to the following payer mix:

- Medicare - 25%

- Medicaid - 10%

- Commercial Payer 1 - 20%

- Commercial Payer 2 - 10%

- Commercial Payer 3 - 10%

- Commercial Payer 4 - 20%

- Commercial Payer 5 - 5%

After a comprehensive meeting to discuss their opportunities and what strategy we will be taking with the payers, we analyzed the practice’s CPT codes according to the payer mix above and weighted the number of encounters.

We found what each of the payers was reimbursing, as compared to Medicare, indicated in the graph below:

You’ll notice Payers 1, 2 and 3 are paying at a similar rate. Payer 4, on the other hand, is pulling the average down and is one of their largest payers. This was seriously impacting the practice’s finances. So, how did NGA proceed? We created an irrefutable value proposition and a strong negotiation strategy.

The Outcome

Using our long-standing health plan contacts, we started the several month-long negotiation process. Even after initially refusing any increases, the Payer ultimately agreed to an 18% increase over current rates from 78.25% to 96.25%. The result?

An extra $168,483 per year - year after year!

All of that revenue was essentially profit for the practice. No additional expenses were required to increase their bottom line.

All with just ONE payer. Imagine what that could mean for your practice.

We negotiate insurance contracts for a variety of specialties:

- Ambulatory Surgery Centers (ASCS)

- Allergy & Immunology

- Addiction and Drug Treatment Centers

- Anesthesiology (Pain Centers)

- Behavioral Health (Psychiatry/Psychology)

- Cardiology

- Dermatology

- Dentistry

- Ear, Nose, and Throat

- (ENT/Audiology/Otolaryngology)

- Emergency Medicine

- Gastroenterology

- Interventional Radiology

- Imaging Centers Labs

- Neurology

- Obstetrics & Gynecology

- OBLs (Office Based Labs)

- Ophthalmology & Optometry

- Orthopedic

- Pain Management

- Primary Care

- Podiatry

- Radiology-Diagnostic

- Surgery (General, Eye, Endovascular, Hand, Orthopedic, Retinal, Spinal, Vascular, etc)

- Urology

Get a Free Consultation

Contact NGA Healthcare today to see how we can help optimize your practice.

Frequently Asked Questions

How can my medical practice benefit from professional insurance contract negotiations?

Any group that has contracts with payers and has not negotiated their contracts in the last three years is most likely leaving money on the table. We find that most physicians need our services as they have never negotiated their contracts since they started their practice.

How much does it cost to negotiate contracts?

We provide our services on a fixed-fee basis. There are no 'surprise' bills outside of our agreement. We structure our fees based on the number of providers in the practice.

How much does it cost to negotiate contracts?

We provide our services on a fixed-fee basis. There are no 'surprise' bills outside of our agreement. We structure our fees based on the number of providers in the practice.

Why? Because larger practices have a higher financial impact to the payers and the negotiations require substantial time and resources. Below are the calculations we use to determine contract negotiation pricing:

(Number of providers * $1,000) * number of payer plans (minimum of 4 plans)

So, for example, a group of 2 MDs and 1 NP would be (3 * $1,000) * 4 plans = $12,000

Is this a substantial investment? Yes, it is. But understand that, based on our track record, the average reimbursement negotiation provides you an increase that amounts conservatively to 5 times the initial investment in just the first year.

In this case, that’s about $60,000 in additional revenue if we get the average increase from just one payer in the first year.

Can you guarantee that I will get an increase?

Nobody can guarantee an increase as there are far too many factors to consider. We can say that historically, in 99% of cases, we are able to get at least one plan to increase rates that more than covers our fees and offers a generous return on your investment (generally 5X in just the first year). This is the reason why we work with more than one of your plans - it increases the chances that we will get at least one contract increased.

How big of an increase can I expect?

Increases are generally in the 10% to 20% range. Certainly, it's better to focus on the impact of the increase. A 7% increase on your largest payer is worth much more than 20% of your lowest. Reimbursement increases have significant impacts to your bottom line and profit/salary because the additional revenue requires no additional overheard or work.

What is the typical timeline for completing the negotiation process?

On average renegotiations take 6-9 months from when we can commence the negotiations, and new contract negotiations average between 4-8 months from obtaining the practice information. The time ranges are highly dependent on the individual payers, practice specialty, and practice location.

How much involvement is required from my practice during contract negotiations?

Very little, as we have a team of expertise that can do the work for you. Your practice will be involved in the initial kickoff call where we will get the necessary data to model your potential current revenue and offers. We will then meet with you to share the analysis.

After this point, our team will be the lead in all the negotiations and will not need any involvement from your practice. We are happy to meet with you to provide updates and details on any offers we receive. We do not accept any offers until we review with you and get your approval.

Can NGA Healthcare manage negotiations with multiple insurance providers simultaneously?

Yes, absolutely and we do this every day. We have a team of over 50+ skilled negotiators, analysts, and a provider services team that have specialized and worked with almost all payers including United Healthcare, BCBS, etc.

What happens if the negotiation process does not yield the desired results?

This is very unlikely to occur as we’ve successfully negotiated for over 99% of our clients. In the event that we aren’t able to obtain a new contract or negotiate an increase on an existing contract, we will return any qualifying and guaranteed initiation fees we’ve collected.

Does NGA Healthcare offer ongoing contract management and fee schedule updates as part of their services?

No, NGA Healthcare only charges initiation fees (which are guaranteed as long as we negotiate at least 5 health plans), and performance based fees. Essentially, we don’t get paid unless we obtain a new contract or rate increase for your practice.

What steps are involved in the insurance contract negotiation process?

The first step after signing an agreement with NGA Healthcare and paying any associated initiation fee is the kickoff call. During the kickoff call we go over the welcome kit, which is an online form for sharing practice information needed for negotiations.

NGA then uses this information to submit offers and request any missing contracts/fee schedules needed to model the practice’s rates. If it’s a new group then we are also submitting all the applications, and starting the negotiation process.

Once the increased offers or new contract offers are obtained, NGA Healthcare will share them with the practice and facilitate the signature of the agreements if the rates are acceptable.

What are the fees associated with contract negotiation services?

We charge an initiation fee (which is guaranteed if we don’t get any increases) that is determined by your practice size/specialty/location, flat fees for new contracts, or a percentage of the value brought to your practice.

What rate increases can typically be expected from successful negotiations?

Increases and rates vary greatly depending on a number of factors including: specialty, location, size of the group, facility type, age of the contracts, etc.

Is it worthwhile for me to negotiate my insurance contracts?

Every group should be negotiating their payer contracts as often as possible. Negotiating contracts before you sign them is the most important time to negotiate.